Chances are that at some point you’ll be looking to rent a self storage unit for an extended period time. This might be because:

Chances are that at some point you’ll be looking to rent a self storage unit for an extended period time. This might be because:

- You’re selling your home, or relocating.

- You’re in a changing relationship status, and need to quickly move out of your current digs.

- You’d like a place to safely store the items that won’t fit into your home or office.

Or for any number of other reasons requiring a safe place to keep your belongings in the short or longer term.

If you’re in this situation, one of the first things that the storage company will want to know is if the items you wish to store are insured. And if they aren’t insured – for example, under your homeowners policy (not the best option) or renters insurance (also not the best option) – they’ll offer to sell you some of their own.

This is really not the best option – and there are several reasons why.

Avoid Insurance Offered by Self Storage Companies Because It’ll Be Expensive!

For what you’re getting (and that probably won’t be much, as we’ll see), the insurance offered by self storage companies is typically very expensive, with premiums marked up as much as 100-200% of the true cost of the insurance. Remember, this is their opportunity to make some extra money from your rental contract – and they’ll be looking to make as much of it as they can.

Storage facilities often mischaracterize their policies as “pass through” costs to the renter, when in fact they are over-charging their customers and splitting the premiums they charge with their insurance carrier.

And You Won’t Get Much Coverage

In addition to having you sign a waiver excusing them from any responsibility for lost, damaged, or stolen items as you’re loading up, most self storage facilities won’t provide insurance coverage for:

- Money stored on site

- Jewelry and other valuables

- Vehicles

- Bills or debts

Coverage for fire, theft, or water damage may have to be negotiated separately and most policies offered directly at the storage facility don’t offer these additional coverages.

Some companies may only cover damage to the storage unit itself – not the items stored in it.

Not to Mention the Hassle of Filing Claims: Pay-outs Could Be Low – And A Long Time, Coming

Filing a claim and getting payment on a self storage company’s insurance policy may also be a painful process. Many of these policies have high deductibles (money paid by you before receiving money for covered damages), a long wait before your payment arrives, and a low pay-out at the end of the ordeal.

The option that the storage company probably won’t want to tell you about is to protect your belongings by taking out a comprehensive self storage policy with a reputable independent insurance provider – a move that will give you much greater coverage and financial protection, for a considerably lower price.

And, You Might Have to Share

Some self storage companies will have a blanket insurance policy covering their entire facility. And they’ll use this as an umbrella to cover all the people renting storage units from them, by offering to sell you a share in their coverage.

The problem is, the coverage on policies like this usually isn’t that great. And you could lose out on the financial protection for your belongings, by only being entitled to a small share of any pay-out.

Another downside is that the insurance offered by self storage companies might be part of a larger risk pool which protects the insurance company rather than the tenant.

Make Sure to Properly Insure Your Belongings in Storage with SnapNsure™

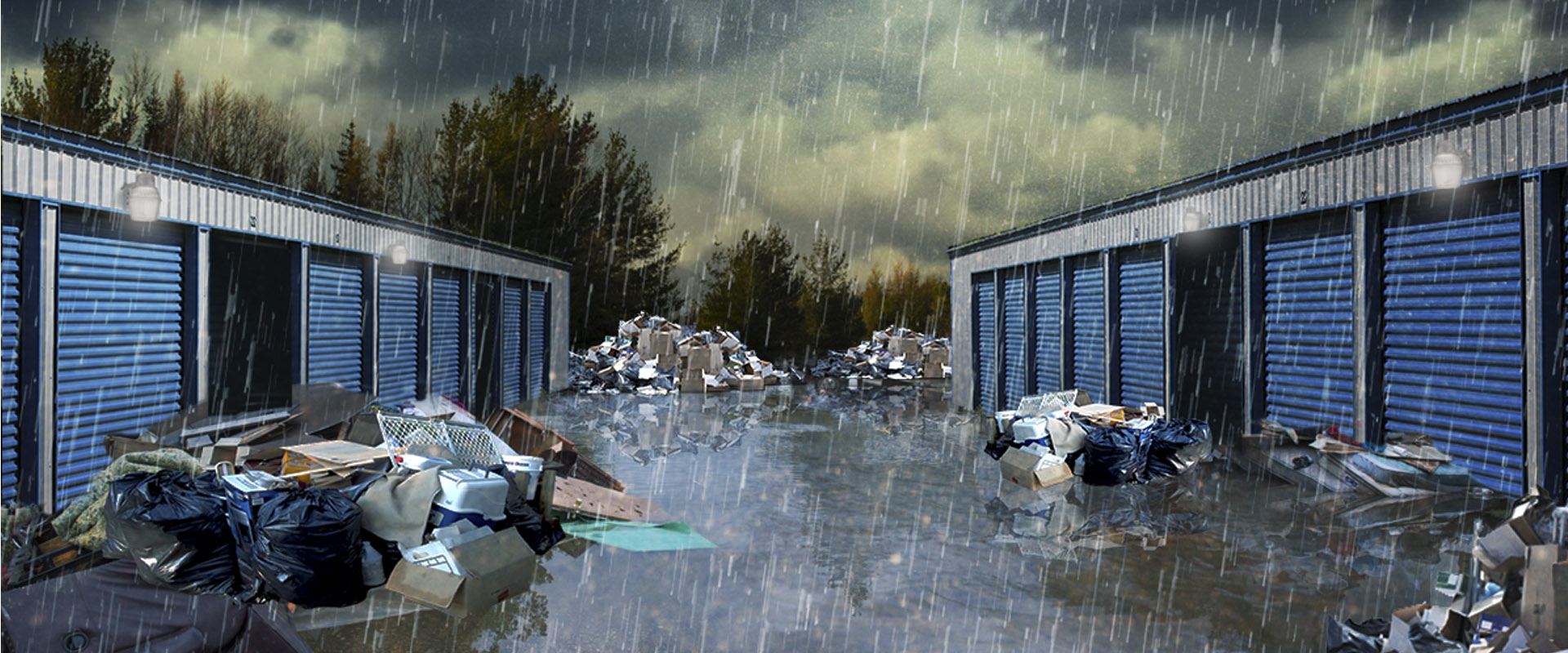

Whether you use self storage for personal or business reasons, you need to be sure that your stored items remain safe from theft, pests or rodents, and damage due to environmental factors such as fire, flooding, storms, and lightning.

When it comes to pricing, coverage, convenience, and reliability, the SnapNsure™ Contents Program is the best choice as a consumer to address all of these concerns. Coverage plans range from a minimum of $2,000 up to a maximum of $25,000 of coverage per unit.

And it’s far more comprehensive, allowing you to add specific incidents coverage for Named Storms, Flood, Rodent, and Earthquake. SnapNsure™ is the only company in the U.S. offering all of these coverages together – and the only company offering Named Storm coverage for self storage, at all.

SnapNsure™ is a “direct-to-consumer” product with no middleman, SO YOU WILL SAVE MONEY over the insurance offered by self storage companies! Our premiums are typically 100% to 200% lower for the same coverage limits offered at the storage facility (storage facilities typically mark up their premiums, with a sizable profit going straight to the storage company).

And every SnapNsure™ policy has a standard $100 deductible.

Coverage renews every month upon payment of your SnapNsure™ premium. It starts as soon as your completed application is received electronically by the SnapNsure™ website – so you can even purchase coverage on your cell phone as you’re signing the storage facility’s rental contract. Simple right!

SnapNsure™ is underwritten by The Hanover Insurance Group – the holding company for one of the largest, admitted insurance carrier’s in the United States.

It simply makes sense to get the coverage you need from SnapNsure™. Get Insured now!